How Long Does Foreclosure Stay on a Credit Report?

If you are facing foreclosure or have already been through foreclosure, you may wonder: How Long Does Foreclosure Stay on a Credit Report? Most of my clients who are facing foreclosure want to keep their properties. There are lots of options for those facing foreclosure in DC, Maryland or Virginia. If you want to save […]

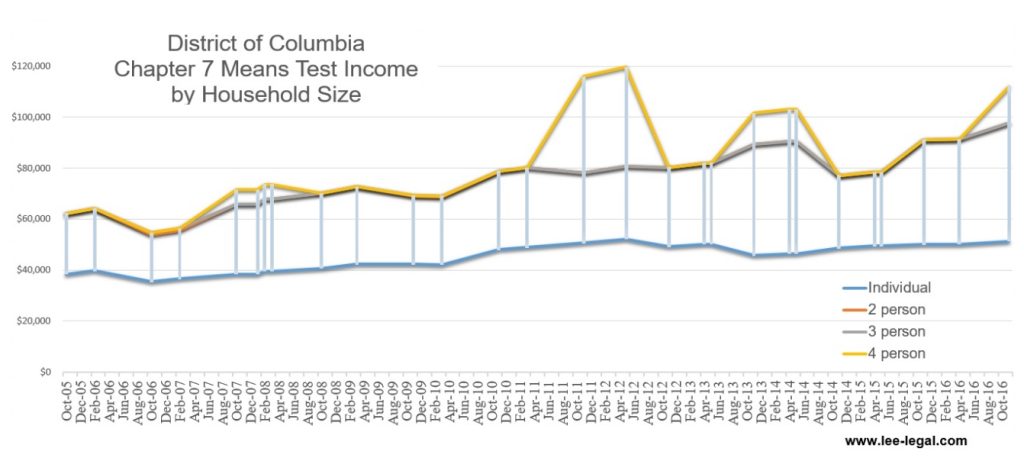

D.C. Means Test Unjustly Denies Chapter 7 Bankruptcy Protection

New Chapter 7 bankruptcy means test numbers take effect today for Chapter 7 cases filed on or after November 1, 2016. The D.C. means test numbers are obviously miscalculated and unfairly exclude bankruptcy debtors in the District of Columbia. Since October 17, 2005, the Department of Justice has promulgated median incomes for Chapter 7 debtors. To qualify for Chapter 7 bankruptcy, you […]

The Debt Buying Industry

Delinquent debt has given rise to an entire debt buying industry. When a debt becomes seriously delinquent, the bank holding the debt will write it off then sell it to a debt buyer, like Midland Funding, for a tiny fraction of the amount of the debt. In turn, that debt buyer might sell it to yet […]

Top 6 Reasons Loan Modifications Are Denied

When facing foreclosure, the best way to get your mortgage back on track is to obtain a modification. You will need to complete your lender’s loss mitigation package. Loss mitigation involves the submission of various financial documents and a Request for Mortgage Assistance (or RMA). The lender will make a cursory review of your application, then […]

Get a Mortgage Modification with Chapter 13

When you cannot afford to pay your mortgage, there are a few possible outcomes, including a short sale or foreclosure. If you want to keep your home, however, the best solution is usually mortgage modification. Mortgage modification involves changing the terms of your mortgage loan so that it becomes more affordable to you. Mortgage modification […]

Should I Worry About My Fiance’s Bankruptcy?

Marriage is much more than the spiritual union between two people. Marriage also joins two otherwise completely separate lives — socially, legally, and financially. A problem in one spouse’s life will affect both, and that includes any financial problems, too. You may be engaged to marry someone who just filed for bankruptcy, or someone who […]

Foreclosure Defense in Washington, D.C.

Lee Legal provides foreclosure defense in Washington, D.C. We defend homeowners and commercial property owners facing foreclosure in D.C. Superior Court. If you receive a Complaint for Judicial Foreclosure, there are deadlines to file papers with the court. Once you are served, you have only 20 days to file and serve an Answer to the Complaint. As soon […]

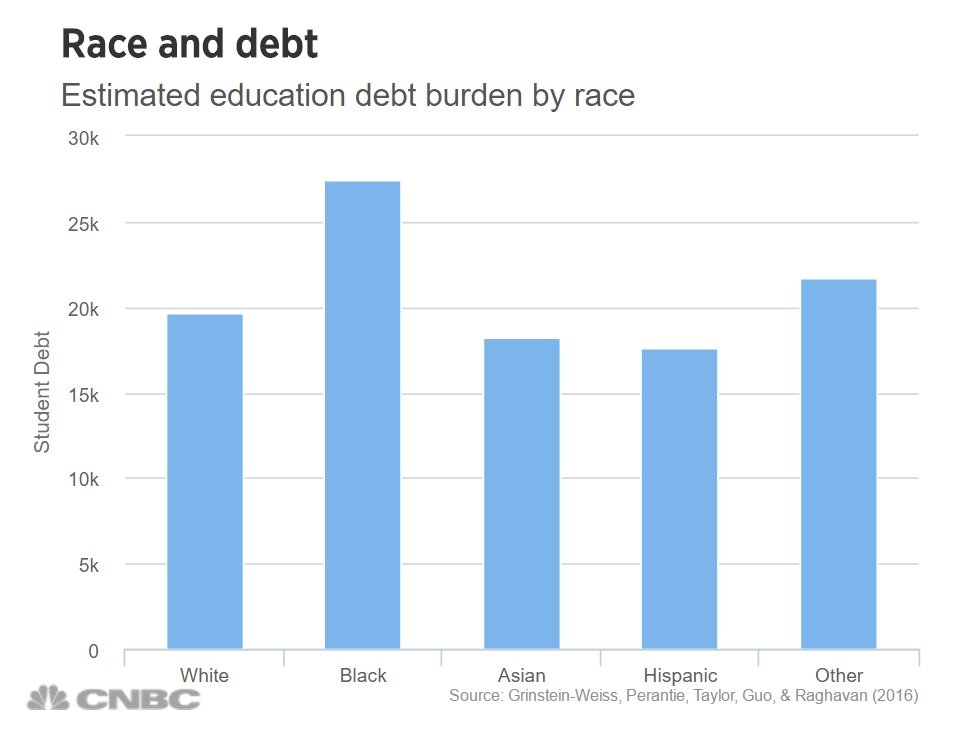

Student Loan Forgiveness Could Narrow the Racial Wealth Gap

The racial wage gap is wider today than in it was in 1979. And according to this recent Washington Post article, student debt is exacerbating the gap. Student loans make it more difficult for to save money and accumulate assets. Targeted student loan forgiveness could narrow the racial wealth gap. Education levels directly influence both economic opportunity and […]

Loss Mitigation Waterfall Should Continue Post-MHA

In July 2016 the Consumer Financial Protection Bureau (CFPB) released a report titled Guiding Principles for the Future of Loss Mitigation. The report lists several “lessons learned” from the financial crisis and makes recommendations to mortgage lenders and servicers for a post-MHA era. One specific suggestion is the permanent adoption of the loss mitigation “waterfall” model. The […]