Maryland cuts time period for pursuing foreclosure debt

As reported in the Washington Post, Maryland has shortened the time for mortgage lenders to collect on foreclosure debt from 12 years to 3 years. The measure passed 47 to 0 in the Maryland Senate and 102 to 33 in the House of Delegates. When a foreclosure takes place, the mortgage lender may obtain a […]

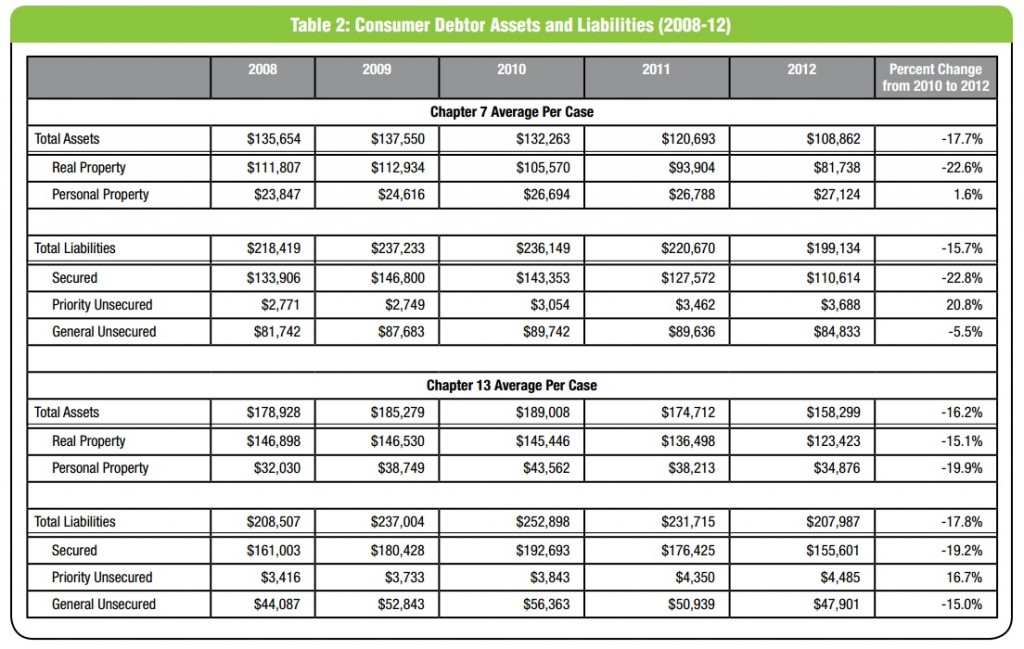

Bankruptcy Debtors by the Numbers

If you’re interested in who is filing bankruptcy, look into the latest ABI Journal’s Bankruptcy by the Numbers to learn more about bankruptcy debtors by the numbers. Decline in bankruptcy filings Bankruptcy filings have declined by nearly one-third since peaking in September 2010. And the total number of bankruptcy filings across all demographics have declined […]

Saturday Office Hours for Bankruptcy Clients

Lee Legal offers Saturday office hours for bankruptcy client consultations. We know you’re busy. It can be tough to take time off work. If you prefer weekend appointments, we can accommodate you. Flexible office hours for busy clients Our Saturday office hours are between 9AM and 3PM in the Washington, D.C. office, located a block […]

Does Bankruptcy Get Rid of Student Loans?

Today, the average student in the United States graduates with $29,400 in student loan debt. High youth unemployment may make it very difficult for many of these students to repay their student loans. As a result, young people struggle with monthly payments they cannot make. Many wonder: Will bankruptcy get rid of student loans I […]

Are You Living Paycheck-to-Paycheck?

If you are living paycheck-to-paycheck, you are not alone. Last week the Brookings Institution released a new article by Princeton and NYU economists entitled The Wealthy Hand-to-Mouth. Some of the article’s findings were startling: Roughly one-third of American households — 38 million of them — are living a payday-to-payday existence. These families hold little to no […]

Protecting Assets in Bankruptcy in DC, VA & MD

Most people seeking bankruptcy protection are naturally concerned about their assets. Getting rid of your debt is great, but not necessarily if you lose your home, your car, your tax refunds, bank accounts, or other possessions. Protecting assets in bankruptcy is the main reason to hire a bankruptcy lawyer. Protecting assets in bankruptcy in Washington DC, […]

Debt Settlement Attorney in Washington D.C. and Virginia

You may not want to file personal bankruptcy on a debt. You may owe just a single debt, or maybe just a few. In some cases, it makes more sense to consider debt settlement over bankruptcy. Consider hiring an experienced debt settlement attorney in Washington D.C. and Virginia to engage in debt settlement on your behalf. A creditor […]

Mistakes People Make Before Calling a Bankruptcy Lawyer

Many people find it difficult to take the first step when facing debts they can’t pay. There is nothing wrong with being confused or uncertain. Dealing with collections calls and bills you cannot pay is a hassle. However, you can act to protect yourself so you don’t accidentally end up making your financial situation worse. […]

Why You Should Always Fight a Credit Card Lawsuit

When you are sued for an unpaid debt, usually it is not the original creditor who is filing the action against you. Instead, the creditor has likely sold the debt to a collector for pennies on the dollar. Debt collectors file hundreds or even thousands of lawsuits on a monthly basis with the hope that […]