How Often Can I File Bankruptcy?

If you have filed a previous bankruptcy and you received a discharge, you may wonder: “How Often Can I File Bankruptcy?” The Bankruptcy Code specifies certain time limits as to when you can file bankruptcy again and obtain a discharge. If your case was closed or dismissed, however, and you did not obtain a discharge […]

Should I Stop Paying My Bills?

I often get asked the question, “If I am filing Chapter 7 bankruptcy, should I stop paying my bills?” The answer is Yes and No. Continue to Pay the Bills You Will Still Have After Bankruptcy First the No. You must continue to pay certain bills. These include your rent or mortgage, auto loans for any […]

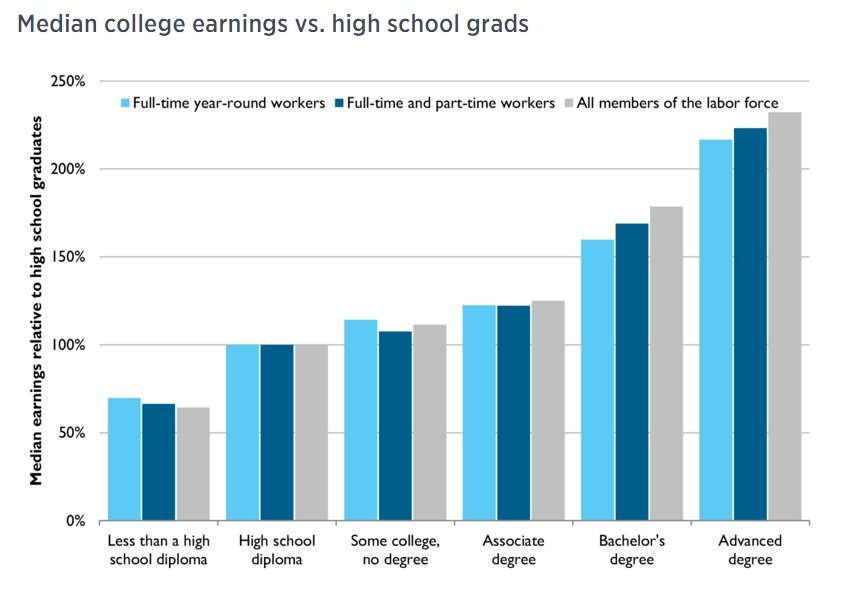

Are student loans dischargeable in bankruptcy?

In the United States there is more than $1.2 trillion in outstanding student loan debt, 40 million borrowers, an average balance of $29,000. Are student loans dischargeable in bankruptcy? No. If you are considering filing for bankruptcy in the Washington, D.C. area, you should know that student loan debt is generally nondischargeable, which means that […]

The Downsides of Reverse Mortgages

A “reverse mortgage” is essentially a mortgage loan for a homeowner at least 62 years of age who owns a primary residence free and clear of any liens, or who has significantly paid down the balance on the existing mortgage. Reverse mortgages typically only become due when the borrower passes away. When considering a reverse mortgage, […]

Can the Bankruptcy Trustee Take My Tax Refund?

Your income tax refund is basically an interest-free loan to the government. If you have paid more in taxes than you owe, then the government must repay you for your overpayment. Especially around this time of year, clients ask me the the same question. Can the Bankruptcy Trustee Take My Tax Refund? The short answer […]

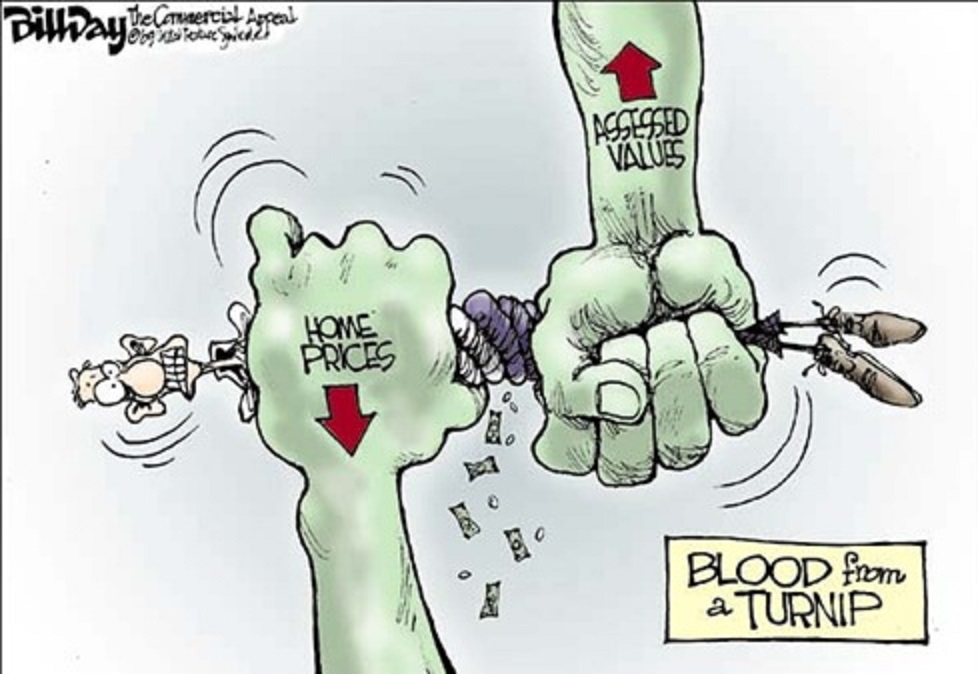

Beware of Temporary Mortgage Modifications

On December 1, 2010, Chris Dodd’s final Senate hearing featured testimony from senior Fannie Mae and Freddie Mac executives. These execs blame mortgage servicers for triggering the mortgage meltdown. As a bankruptcy lawyer practicing in Washington, D.C. and Virginia, I have had several clients report the following scenario to me about temporary mortgage modifications. The homeowner […]

Washington, D.C. Officials Combat Foreclosures

On October 27, 2010, Washington D.C. Attorney General Peter Nickles issued a homeowner-friendly Statement of Enforcement. The statement prohibits the commencement of any foreclosure against a D.C. homeowner unless the current mortgage note holder demonstrates the note’s recordation with the District’s Recorder of Deeds. The statement was intended to combat foreclosures initiated without proper documentation. Washington, […]

Anatomy of a Foreclosure: How Foreclosure Works

Foreclosure activity in the U.S. totaled 676,535 properties in 2017, down to a 12-year low. Foreclosure activity includes default notices, auction sale notices, and bank repossessions. Many of those seeking foreclosure assistance ask how foreclosure works. If you are seeking to avoid foreclosure in Washington DC, Maryland, or Virginia, you must educate yourself quickly and […]

Gambling Debts Can Be Discharged in Bankruptcy

Gambling is a form of entertainment for some, but a serious addiction for others. Most people gamble for fun and know when to stop. But compulsive gamblers suffer from an addiction disorder and need professional help. In the past, bankruptcy courts regularly found gambling debts nondischargeable in Chapter 7 bankruptcy. Today, however, courts allow the […]