With the Credit CARD Act of 2009, Congress enacted the most sweeping changes in credit card laws in decades. The majority of consumer protections kicked in on February 22, 2010. Now credit card companies are required to divulge how many months it will take to pay off a balance if only minimum payments are made. Statements must also indicate how much needs to be paid each month to pay off a balance within three years.

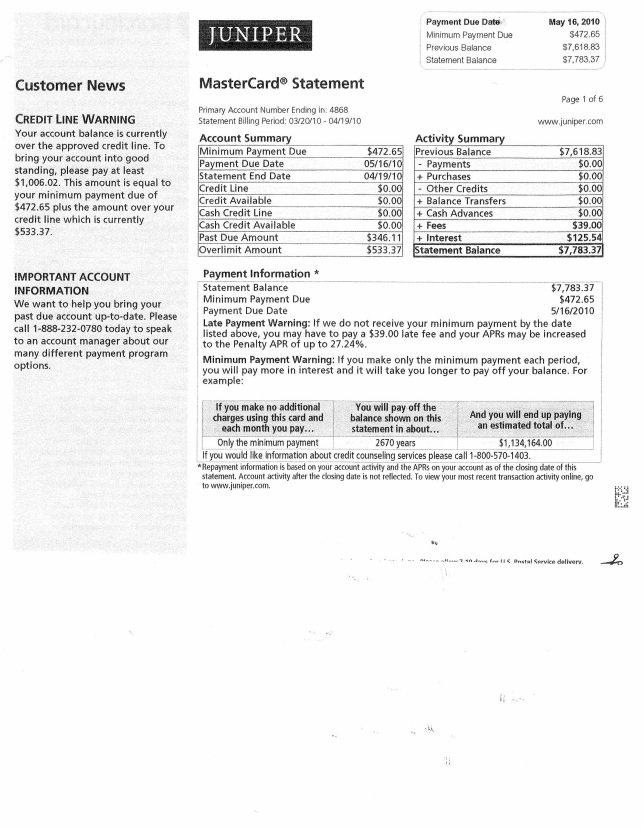

Check out this credit card statement from Juniper. A client provided this statement to me. I have redacted the cardholder’s personal information.

As the statement shows, it will take this credit cardholder $1,134,164.00 to pay off the $7,783.37. And just paying the minimum monthly payment will take 2,670 years to pay off the balance. With a 27% interest rate, and even should the cardholder pay more than the minimum payment, this balance will take much more than a lifetime to pay off completely.

If you are able to make only the minimum payments on your credit cards, consider ways of breaking the cycle. Debt settlement and bankruptcy may be better options for you. If you have out of control credit card debt, call Lee Legal at (202) 448-5136 to schedule a free consultation. Talk to an experienced personal finance attorney serving Washington, D.C., Maryland and Virginia.