If you’re interested in who is filing bankruptcy, look into the latest ABI Journal’s Bankruptcy by the Numbers to learn more about bankruptcy debtors by the numbers.

Decline in bankruptcy filings

Bankruptcy filings have declined by nearly one-third since peaking in September 2010. And the total number of bankruptcy filings across all demographics have declined broadly since 2010. Bankruptcy debtors need not report their gender, age, or educational background. Nor must they report the factors that led them to file for bankruptcy. Still, we can glean some very interesting insights about bankruptcy debtors by the numbers.

Changes in bankruptcy debtors

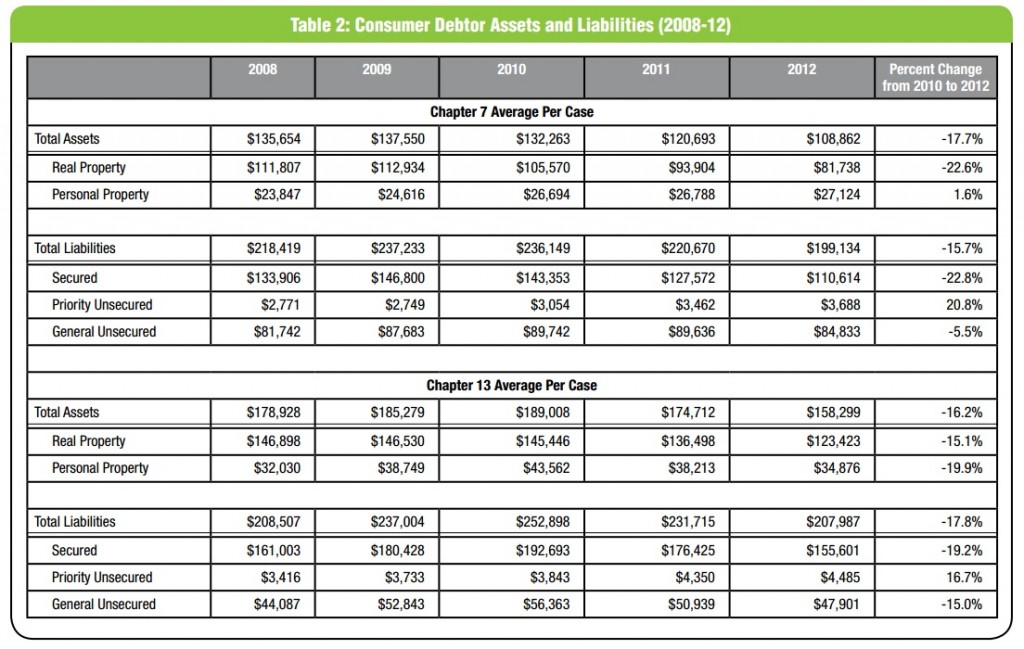

In both Chapter 7 and Chapter 13 cases, assets and liabilities per case were considerably lower in 2012 than in 2010, particularly in the categories of real property and secured debt. In addition, median debtor income and expenses increased from 2008 to 2010 as total filings were increasing. Median income and expenses have decreased for debtors in both Chapter 7 and Chapter 13 since 2010. In fact, the typical debtor in 2012 reported lower assets and debts, lower income, and lower expenses than the typical debtor in 2010.