The debt collection industry makes several billion dollars annually. From Q4 2009 through Q2 2015, no fewer than 33 percent had a debt collection item on their credit reports. Today, 28 percent of Americans have negative collection debts weighing down their credit scores. If you have a debt in collection on your credit report, you’re not alone.

In July 2019, the Consumer Financial Protections Bureau (CFPB) released a report on Third Party Debt Collections Tradeline Reporting, based on the latest data available, from Q2 2018. A “tradeline” is another name for an entry on your credit report. Tradelines are considered negative credit items and can remain on a credit report for seven years.

The debt buyer and debt collection industry

The CFPB estimates there are 9,330 debt collectors and debt buyers in the United States. The top four largest debt buyers reported 90 percent of all reported buyer tradelines on credit reports. Debt collectors often become debt buyers, as the CFPB notes:

Debt collectors usually work traditional,

Market Snapshot,

non-buyer accounts

on a contingency fee basis

while they work buyer accounts

by purchasing portfolios of accounts

and keeping all of what they collect.

CFPB (July 2019)

Debt in collection on your credit report? It’s likely a medical debt.

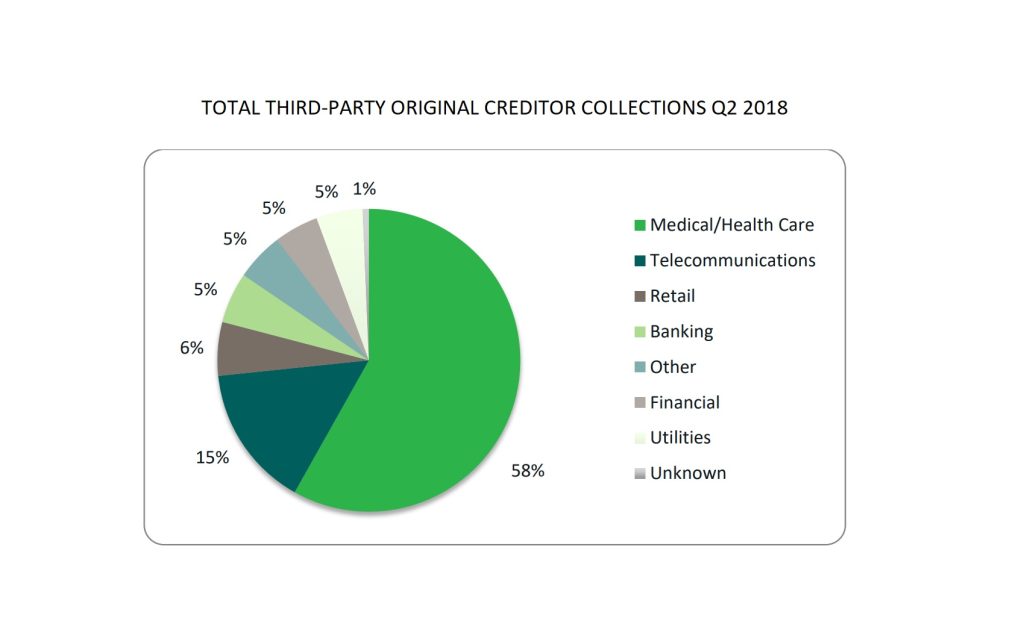

Two-thirds of creditor-collector credit report entries were for medical debts. And medical debts accounted for 58 percent of all third-party collections (debt buyers and debt collectors) as of Q2 2018. But debt collectors frequently report derogatory information for utilities and telecommunications, as well.

These types of credit entries particularly damage credit because they represent nonfinancial debts. Moreover, hospitals and cell phone companies do not report positive payment information to credit bureaus, so the only time these types of debts show up on a credit report are when the information is negative.

Medical debts are dischargeable in bankruptcy

If you have a bunch of medical debts on your credit report, you should consider filing bankruptcy to discharge them. Focus on your recovery — not on the debt. Call an experienced bankruptcy attorney to discuss your options.