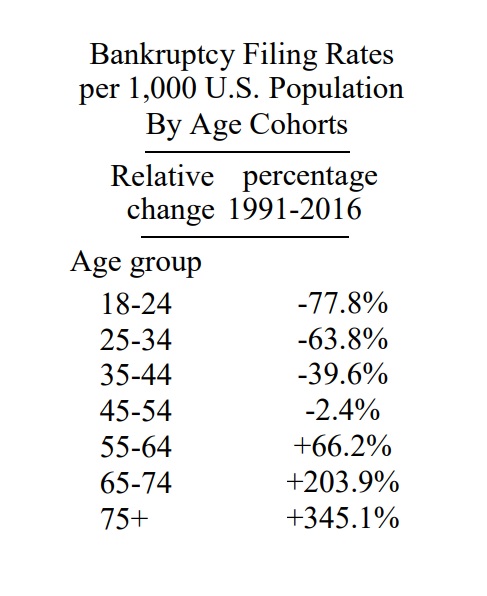

Older Americans are increasingly filing for bankruptcy due to soaring healthcare costs and reductions in social services. According to a recent report, since 1991, the rate of senior citizens filing for bankruptcy protection have increased twofold for Americans 65-74 years old and threefold for those 75 and over. These increases are astonishing and represent a significant shift in the profile of the bankruptcy debtor.

Thorne, Foohey, Lawless & Porter (2018), “Graying of U.S. Bankruptcy: Fallout from Life in a Risk Society,” Indiana Legal Studies Research Paper No. 406.

In 2007, the mean age for bankruptcy filers was 44.4 years, but less than 10 years later, the mean age was 48.5 years. Even when researchers adjusted for an increased numbers of older Americans, they still found that older Americans are more likely to seek protection in bankruptcy courts than in decades prior.

Why senior citizens are increasingly filing for bankruptcy

The report found that declines in income were the leading reason that senior citizens are increasingly seeking bankruptcy protection. In addition, seven out of ten older bankruptcy filers stated that they filed because of the stress of dealing with debt collectors. Medical expenses also contributed to the decision to file bankruptcy for more than six out of ten.

Older bankruptcy filers carried debt loads of more than three times their annual incomes and had a negative net wealth of $17,390 at the median.

Moreso than subsequent generations, older Americans feel morally obligated to repay their debts. The report found that more than six out of ten older debtors struggled for at least two years before finally turning to bankruptcy.

Bankruptcy offers older Americans a way out of debt

According to the N.Y. Federal Reserve’s latest quarterly household debt and credit report, transitions into serious delinquency for credit card accounts have yet again increased. While this rate is highest for younger borrowers, it has risen sharply among older borrowers over the last two years.

Struggling for several years

Graying of U.S. Bankruptcy,

to repay one’s debts

is an unfortunate way to spend

one’s retirement years.

Thorne & Foohey (2018)

Regardless of the underlying causes, older Americans facing unsustainable debt loads should seek the advice of bankruptcy counsel. Before depleting savings or emptying retirement accounts to service debt, seniors should first consider all the options, including bankruptcy protection.