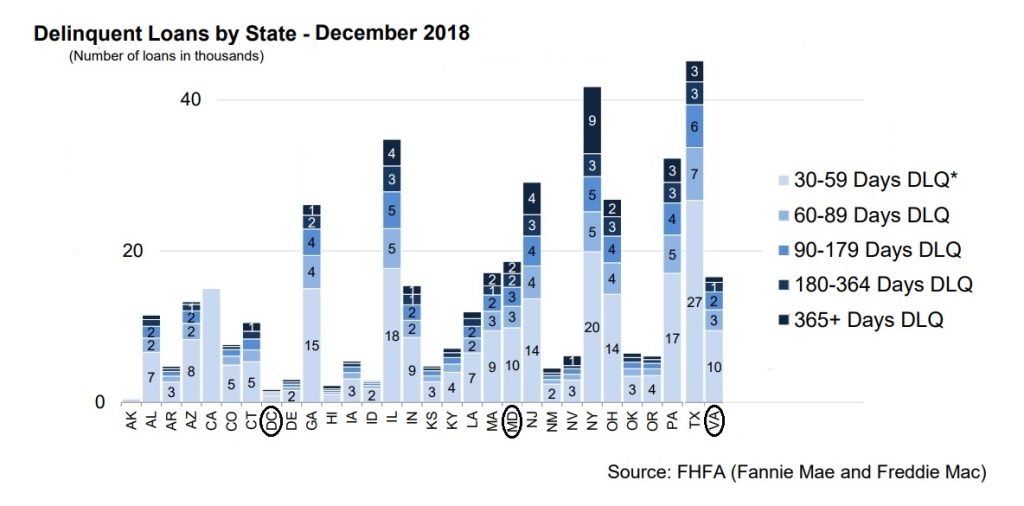

According to the 2018 4Q FHFA Foreclosure Prevention Report, Washington, D.C. boasts one of the lowest mortgage default rates in the country, while Virginia and Maryland mortgage delinquency rates rank among the highest.

The District of Columbia, Maryland and Virginia are circled in the graph above. Every day, Lee Legal helps homeowners facing mortgage delinquency.

All things equal

Virginia’s unemployment rate remained unchanged last month at 2.9 percent. Meanwhile, the unemployment rate in Maryland last month was 3.8 percent. Those are solid employment rates. While these figures present useful measures by which to gauge the economy overall, they do not explain individual situations. Businesses downsize, and sometimes even fail. Loss of employment often has more to do with circumstance than competence.

With the arrival of Amazon HQ2 and seemingly unending increases in military contract spending, the real estate market in the DMV has never been hotter. So generally speaking, people have jobs and their homes are worth more. All things equal, defaulting on a mortgage makes no sense.

Address mortgage delinquency quickly

Unfortunately, all things are rarely equal. Many different conditions can lead to mortgage default. Virginia and Maryland are both non-judicial foreclosure states, which means the foreclosure process happens without court oversight. You must address mortgage loan deficiency quickly.

That doesn’t mean you need to reinstate the loan. It also doesn’t mean becoming combative with your mortgage company or servicer. But it does mean calling them and keeping them informed of your progress toward some solution. Not paying the mortgage indefinitely will not sit well with them. You have to convince them you have a plan.

Quickly addressing default not only limits the amount of the mortgage loan deficiency, but also buys you the time to assess your options, including a repayment plan, modification, open market sale, or Chapter 13 bankruptcy.