Consider hiring a lawyer for debt defense if you are being pursued by a debt collector. Lee Legal serves the District of Columbia, Northern Virginia, and the D.C. suburbs of Maryland. To understand how the debt collection industry works, read the November 2019 State of Collections report from TransUnion. We did, and there are a lot of interesting facts in there.

What is third party debt collection?

Third party debt collectors attempt to collect on debts owned by creditors. These types of debt collectors include agencies, companies, and lawyers. Typical creditors who use third party debt collectors are hospitals, vehicle lenders, utilities, and banks. Often, these creditors outsource their collections to allow them to focus on their core business. Almost as often, creditors employ third party collectors to avoid the dirty business of debt collection.

Debt collectors have vast (and growing) resources

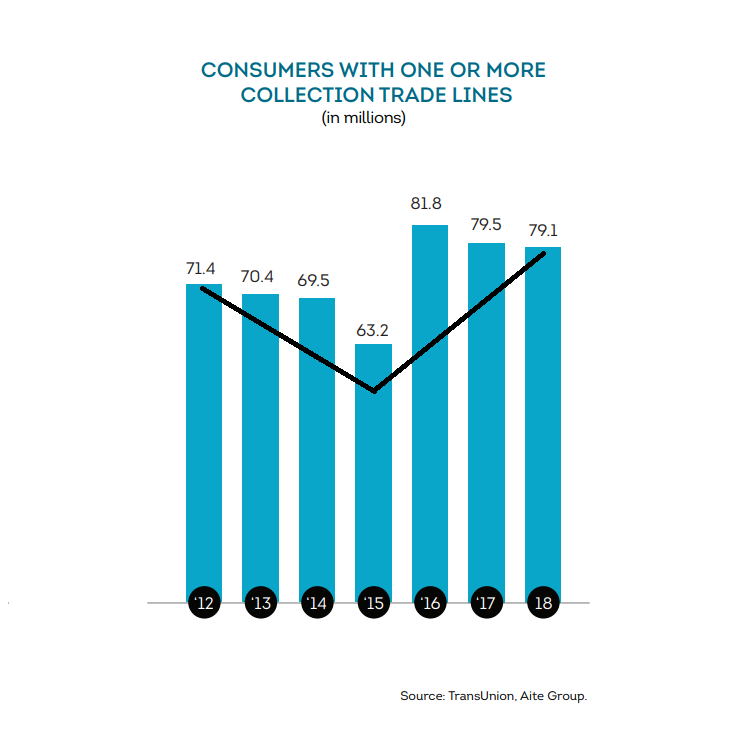

More than 70 million Americans have at least one debt collection item on their credit reports. And debt collectors are currently chasing over $211 billion in overdue debt.

Debt collectors have an expanding set of resources available to them:

- 80 percent of debt collectors use skip tracing

- Debt collectors also widely use other techniques like call recording, predictive dialing, and automated speech analysis

- 21 percent of debt collectors attempt collection on debts that are past the statute of limitations

“Call bombardment” is common method employed by debt collectors. Only 49 percent of collectors limit the number of contacts per week. And just 53 percent of collectors limit the number of contacts per day. Most of these calls involve, of course, threatening to penalize the consumer for not engaging with the collector.

Moreover, debt collectors are looking to new technology to amplify their efforts. 61 percent of debt collectors currently use email, yet another 22 percent are considering adding email to their procedures. No fewer than 69 percent of debt collectors either use or are considering using SMS text messages to contact consumers. And 30 percent of debt collectors are currently using or exploring the use of social media to reach debtors.

Hire your own lawyer for debt defense

Some creditors rarely resort to litigation, while other creditors invariably sue. If you are sued by a debt collector, it should be clear that they intend to collect on your debt. The next step after judgment is garnishment, attachment, lien, and yet more collection efforts.

Many consumer debtors often face an imbalance of power, but that need not be the case for you. Hire your own lawyer for debt defense.