Student Loans Jeopardize Retirement for Older Americans

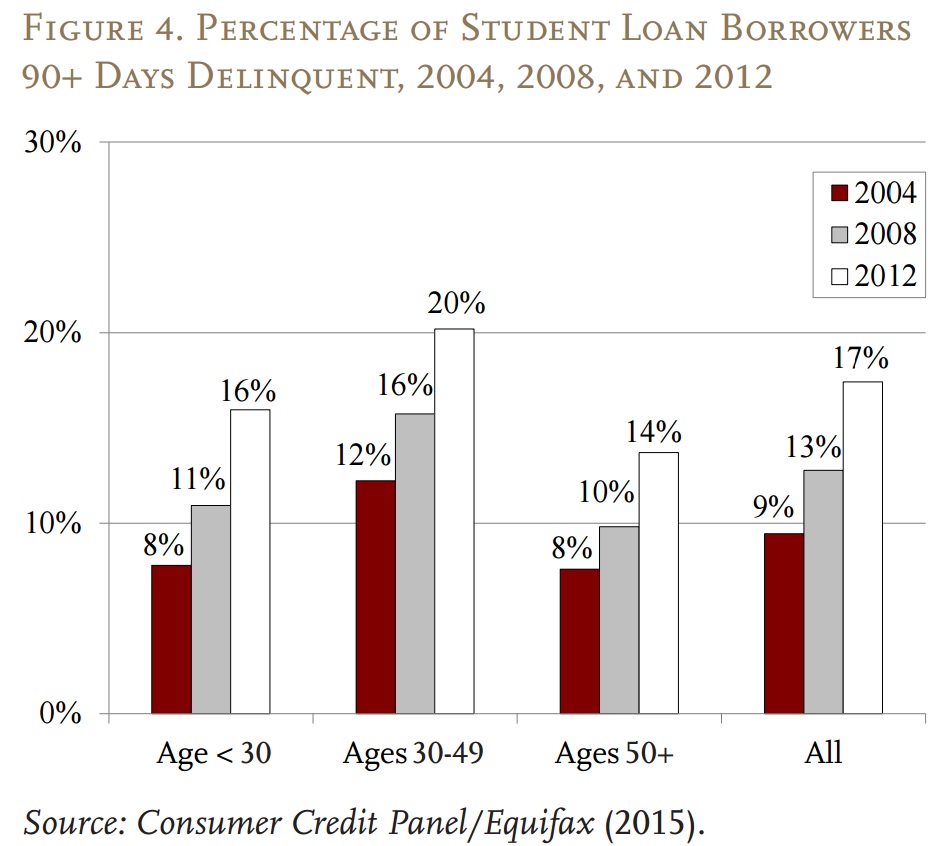

Retirement is supposed to be a time to leave behind the hassles and stress of the workforce. In many ways, retirement is the reward for a lifetime’s contribution to the economy and country. We usually consider student loans to be a problem for the young. But today’s retirees increasingly face crushing student loan burdens. Believe […]

Get a Second Chance at Life with Bankruptcy

Dealing with unmanageable debts can completely take over your life. You don’t get that many opportunities in life to start over. But you can get a second chance at life with bankruptcy. Worrying about losing your car or home can keep you up at night. And debt collectors can make you afraid to answer your phone. […]

You Can’t Go to Jail for a Debt

A long time ago, when our country was very young, the U.S. had separate prisons for people who could not repay their debts. We called these jails “debtors’ prisons.” Today, we think it preposterous to throw someone in jail for simply owing a debt. After all, how would someone earn the money to repay a […]

When to Consider Filing Bankruptcy

In most cases, the very last thing any person wants to do is to consider filing bankruptcy. In many cases, an average person will wait two years longer than he or she should have to file bankruptcy. Don’t rearrange the deck furniture on the Titanic. Instead, realize it may be time to jump ship. You may […]

Can a Creditor Garnish a Paycheck or Bank Account?

A creditor who has obtained a judgment against you can garnish a paycheck or bank account, or both. The creditor must file garnishment affidavit at your bank, at which point the bank will pay that creditor whatever amount is available in your account, up to the amount of the judgment. A creditor will drain your […]

Do Not Run Up Your Credit Cards Before Bankruptcy

Chapter 7 bankruptcy is an excellent option for those who have accumulated large credit card debts. But if you run up your credit cards before bankruptcy, you may be found to have committed a form of bankruptcy fraud. When you file for bankruptcy, credit card companies carefully review all of your most recent purchases. Do […]

Should I Stop Paying My Bills?

I often get asked the question, “If I am filing Chapter 7 bankruptcy, should I stop paying my bills?” The answer is Yes and No. Continue to Pay the Bills You Will Still Have After Bankruptcy First the No. You must continue to pay certain bills. These include your rent or mortgage, auto loans for any […]

Bankruptcy and Marriage

When a spouse is involved, filing bankruptcy can be significantly more complicated than filing a simple individual bankruptcy. The intersection of bankruptcy and marriage can create complicated circumstances for both spouses. In many cases, a married couple may find themselves entering into complex legal territory when considering bankruptcy. There are four major factors that affect […]

Should I File Bankruptcy?

Bankruptcy is not for everyone, and not a decision to take lightly. Over three quarters of a million Americans will declare bankruptcy in 2017. But how do you know if bankruptcy is right for you? If you find yourself asking, “Should I File Bankruptcy?” then read on. Here are a few questions you should ask […]