How Long Will Bankruptcy Stay on My Credit Report?

Bankruptcy can be a life-changing decision. You should definitely educate yourself as much as possible about the ramifications before you file. Your specific circumstances will determine whether bankruptcy is the right choice for you. But you must keep your long-term objectives in mind. On a weekly basis I answer the question: How long will bankruptcy […]

Restrict Debt Collectors from Calling Cell Phones

In November 2013, the CFPB issued an Advance Notice of Proposed Rulemaking soliciting public comments on an array of issues relating to the debt collection practices of third-party debt collectors, debt buyers, and creditors. The CFPB should restrict debt collectors from calling cell phones. In a recent article, Todd Zywicki, law professor at George Mason […]

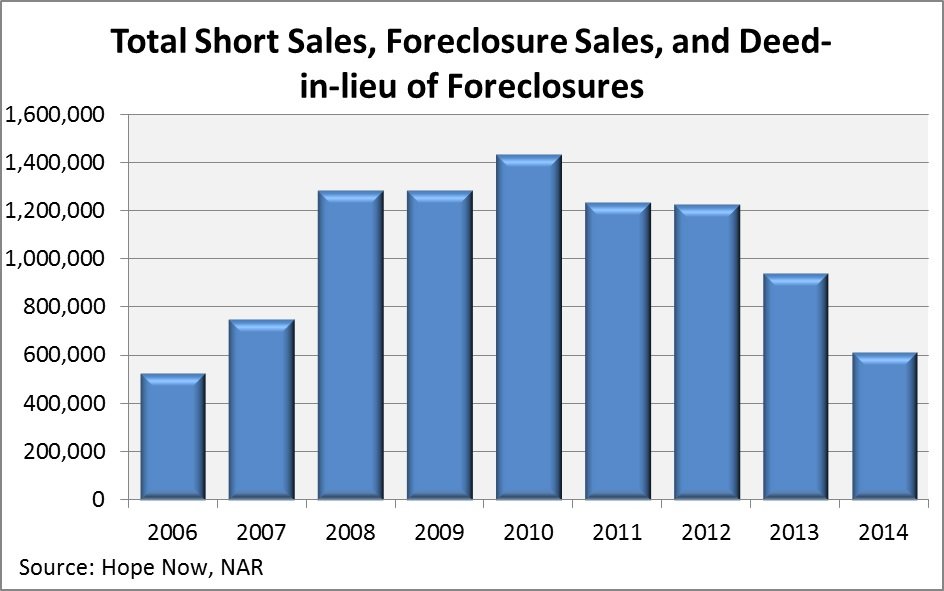

Boomerang Buyers Are Back!

Boomerang buyers are back from the housing crisis. “Boomerang buyers” is the name for homebuyers who had lost their homes to short sales and foreclosures during the housing crisis. Mortgage default rates skyrocketed in 2006, and in the years following nearly 9.3 million borrowers lost their homes. Today, over a million of these boomerang buyers […]

Fannie Mae: DC is Now a Judicial Foreclosure Jurisdiction

On March 16, 2016, Fannie Mae updated its Foreclosure Time Frames and Compensatory Fee schedules to recognize that DC is now a judicial foreclosure jurisdiction. The table specifies Fannie Mae’s maximum number of allowable days between the due date of the last paid installment (or “LPI”) and the foreclosure sale date. Fannie Mae had originally […]

You Do Not Have to Be Broke to File Bankruptcy

Megastar veteran rap artist 50 Cent declared Chapter 11 bankruptcy on August 3, 2015. In his bankruptcy schedules, 50 Cent (real name: Curtis James Jackson III) listed assets amounting to $24,823,899.18 and debts totaling $32,509,549.91. The monthly mortgage payment for his $8.25 million mansion is is $17,400, and the value of his vehicles (including […]

Get a Second Chance at Life with Bankruptcy

Dealing with unmanageable debts can completely take over your life. You don’t get that many opportunities in life to start over. But you can get a second chance at life with bankruptcy. Worrying about losing your car or home can keep you up at night. And debt collectors can make you afraid to answer your phone. […]

Can I Keep My Car If I File for Bankruptcy?

Most people need a car, either to get to work, to shop for groceries, to haul the kids around. If you live in Maryland or Virginia, you need a car, though less so if you live in DC. One of the questions I get asked all the time is, “Can I keep my car if […]

Beware of Offers to Modify Your Mortgage for a Fee

Since the subprime mortgage meltdown of December 2007 to June 2009, mortgage modifications have saved many homeowners from foreclosure. Yet many illegitimate companies and individuals have preyed on people seeking modifications. My advice to you is to beware of offers to modify your mortgage for a fee. On February 17, 2016, a federal grand jury […]

When Should You File for Bankruptcy?

If you’ve been holding off filing bankruptcy, there are some clear indicators of when you should actually throw in the towel. When should you file for bankruptcy? Lee Legal offers free consultations to both businesses and individuals who are weighing their options. When Should You File for Bankruptcy? Bankruptcy is not appropriate for every situation. […]