If you file Chapter 13 bankruptcy and choose not to repay your student loans, you could end up in a worse condition than before you filed. To be sure, you can defer repayment of your student loans during the entire duration of your bankruptcy case. But interest will continue to accrue on any unpaid balances, and you will wind up owing more when the case is over. That can seriously interfere with the core bankruptcy concept of a obtaining “fresh start.” To avoid this, you may want to repay your student loans in Chapter 13 bankruptcy.

Those sticky, sticky student loans

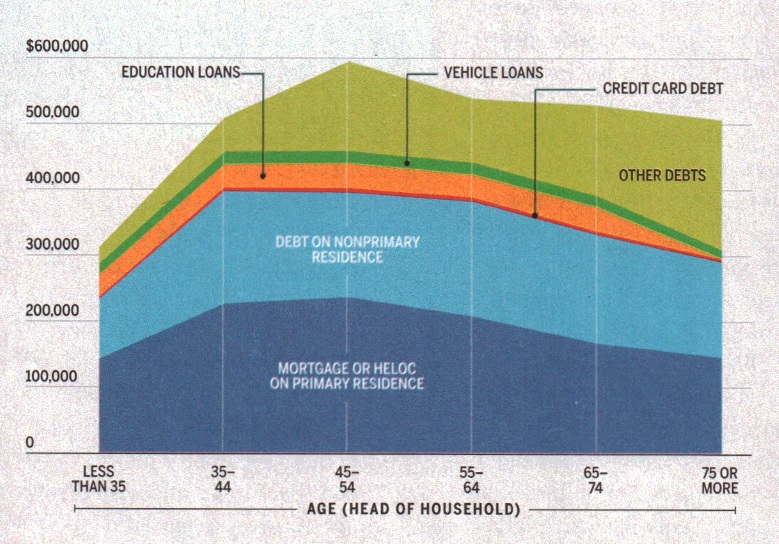

Just look at the graph below, which shows how “sticky” student loans are. The graph represents debt held by different age groups, and the orange bar represents student loans. On average, as you can see, student loans stay with us for much of our lives.

According to the National Association of Chapter 13 Trustees, between 1980 and 2010, the costs for college increased at a rate approximately five times the rate of inflation, and outstanding student loan debt now tops $1.5 trillion. Meanwhile, the default rates on student loans in the U.S. have nearly doubled since 2006. Many young people are filing Chapter 13 bankruptcy to escape the crushing burden of student loans.

Student loans are not dischargeable in Chapter 13

A Chapter 13 bankruptcy will not discharge your student loans. In many cases, you can repay only a percentage of your unsecured debts and discharge the rest of the balances. Unfortunately, however, you will still owe any unpaid student loan balances after you receive a Chapter 13 bankruptcy discharge. The Bankruptcy Code treats student loans differently than it does any other type of unsecured debt.

Call is growing for bringing back the discharge for student loans in bankruptcy. On June 21, 2018, the non-profit, non-partisan National Bankruptcy Conference (NBC) released a position paper recommending reinstatement of the discharge of student loans. The paper notes that many student loans are for ineffective educational programs or programs that the debtor never completes. Astonishingly, almost half of all students who enter college do not graduate and receive a degree.

The editorial board at Bloomberg recently put it best: Let Student Borrowers Declare Bankruptcy, Already.

Repay your student loans in Chapter 13 bankruptcy

While student loans may not be discharged, you can repay your student loans in Chapter 13 bankruptcy. In bankruptcy, the “classification” of claims means grouping together creditors for similar repayment through the Chapter 13 Plan. Most courts have held that student loans are inherently different from other unsecured creditors due to their nondischargeability and are thus are subject to separate classification.

The usual purpose of separately classifying student loan debts is to pay the student loan creditor more than what is being paid to other unsecured creditors. Classifying student loans separately can be accomplished through 11 U.S.C. 523(a)(8), 1122 and 1322 of the Bankruptcy Code.

[I]t is often in the debtor’s interest to pay off

as much of the student loan debt

in the Chapter 13 plan as is permissible.

One way to pay more on the student loan

than on other unsecured debts

is to provide in the Plan that the debtor

will maintain direct ongoing monthly payments

to a student loan creditor . . .

National Bankruptcy Conference,

Student Loan Dischargeability (2018)

You may be able to reduce your payout to unsecured creditors by maintaining your monthly payments to student loans. At the confirmation stage, courts look to balance the financial needs of bankruptcy debtors with those of their creditors. For example, a Chapter 13 Plan may not provide for 100 percent repayment of student loans while the remaining unsecured creditors receive 0 percent. Such a Plan would not be fair to the non-student-loan unsecured creditors.

Talk to a bankruptcy attorney

Claim classification and Plan calculation are as much an art as a science. The bankruptcy trustee, United States Trustee, and bankruptcy judge will closely examine your income and expenses, calculation of disposable income, and claims register to determine whether your Chapter 13 Plan should be confirmed. If you want to repay your student loans in Chapter 13 bankruptcy, talk it over with an experienced bankruptcy attorney.