Old Apartment Lawsuit: Broken Leases

Are you now facing an old apartment lawsuit for a broken lease? Have you moved out of an apartment and still owe rent? There are lots of reasons to move out of an apartment without paying all of the rent that was contractually due: unsafe or unsanitary conditions, call to military service, realizing you’re living […]

Bankruptcy is NOT a Last Resort

You may have heard the myth repeated so many times that it takes on the air of authority. “Bankruptcy is a last resort.” Well, it’s just not true. Sure, you could struggle. You could drain fully protected retirement or savings accounts. Or you could stretch your monthly budget to its breaking point, just to make […]

Should I Get a Credit Card After Bankruptcy?

Once you file Chapter 7 bankruptcy, you will be flooded with new credit card offers. It may seem counter-intuitive, but you should get a credit card after bankruptcy. Credit card companies are not doing you a favor. Once you receive a bankruptcy discharge, you actually become an excellent credit risk. After all, you have zero […]

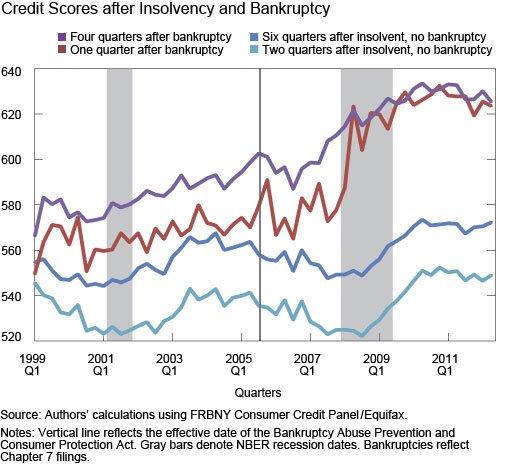

Bankruptcy Can Actually Improve Your Credit Score

An excellent new study by the Federal Reserve Bank of New York examines the effects on households resulting from the 2005 change in bankruptcy laws. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) was signed into law by President George W. Bush. One of the surprising conclusions from the report is that bankruptcy can […]

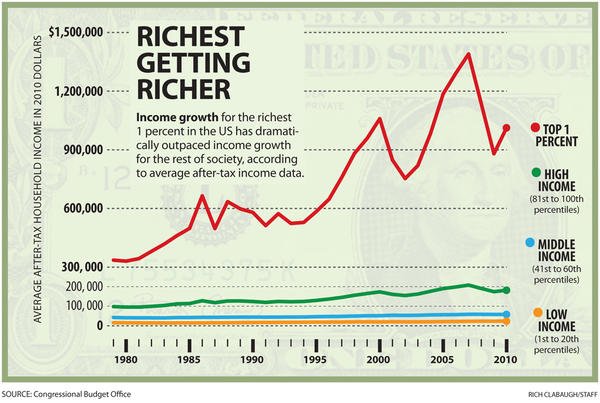

Great Recession Still Troubles the Middle Class

Just released is an insightful new white paper from the Brookings Institution’s William A. Galston entitled The New Challenge to Market Democracies. The author goes further than simply asserting that better policy can reverse the now decades-old trend of income inequality. Instead, he suggests that the feasibility of liberal democracy can be cast into doubt. […]

Inside the Dark World of Consumer Debt Collection

In August 2014, the New York Times published a fascinating article by Jake Halpern entitled Paper Boys: Inside the Dark, Lucrative World of Consumer Debt Collection. The article follows the intertwining tales of Aaron Siegel and Brandon Wilson, two men who invest in “distressed consumer debt.” These guys buy up the right to collect unpaid credit-card […]

The Bankruptcy Threat in Debt Settlement Negotiations

When attempting to settle a debt or otherwise negotiate with a creditor, the bankruptcy threat is a potent weapon. The credible threat of bankruptcy from your attorney can induce a creditor to reconsider his position during negotiations. Creditors More Willing to Negotiate If You Are Willing to File Bankruptcy Suppose you want to settle a debt for less than is owed. Do you […]

Use Creative Destruction to Refocus Your Personal Finances

Austrian-born American economist and political scientist Joseph Schumpeter coined the term creative destruction in 1942. “Creative destruction” is the willful reconfiguration of an existing economic system in order to clear the ground for the creation of new wealth. There are obviously many nuances to the economic theory. But you can use the concept of creative destruction […]

How Long After Bankruptcy Until I Can Buy a Home?

You finished your bankruptcy and got rid of your debts. Now you may be asking yourself: How long after bankruptcy until I can buy a home? The chapter of bankruptcy matters It may not surprise you, but lenders view Chapter 7 and Chapter 13 bankruptcies very differently. Chapter 7 is the quick and easy process […]