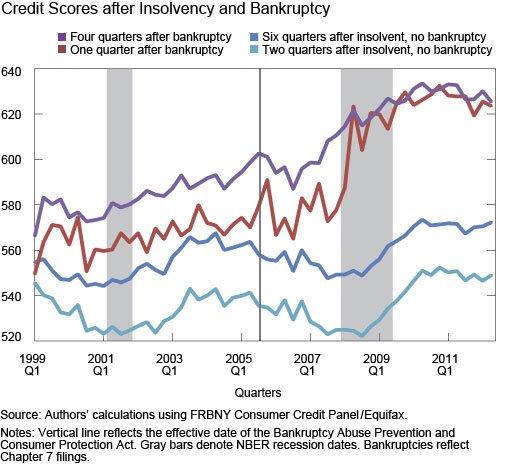

An excellent new study by the Federal Reserve Bank of New York examines the effects on households resulting from the 2005 change in bankruptcy laws. The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) was signed into law by President George W. Bush. One of the surprising conclusions from the report is that bankruptcy can actually improve your credit score. Check out this graph. It tracks the credit scores of people who file bankruptcy, and those who decided not to file bankruptcy.

I have written before that bankruptcy will not kill your credit. The N.Y. Fed report takes this a step further: “The individuals who go bankrupt experience a sharp boost in their credit score after bankruptcy, whereas the recovery in credit score is much lower for individuals who do not go bankrupt.” This may seem counter-intuitive, but the conclusion of the study is clear: bankruptcy can actually improve your credit. In addition, the study, found that “insolvent individuals who do not go bankrupt exhibit more financial stress than those who do.” To be sure, dealing with the stress of bankruptcy can be unnerving. But putting it off or avoiding it altogether is a lot more stressful.

Bankruptcy Can Actually Improve Your Credit Score

If you are in a position in which you know that it is going to take a very, very long time to repay your creditors, you should consider filing bankruptcy now. Putting off the inevitable will only delay the benefits of filing, further erode your credit score, and cause you stress. Most of my clients know when it’s time to file. You may not be sure whether bankruptcy is the right financial choice for your specific circumstances. Call my office and schedule a free consultation.