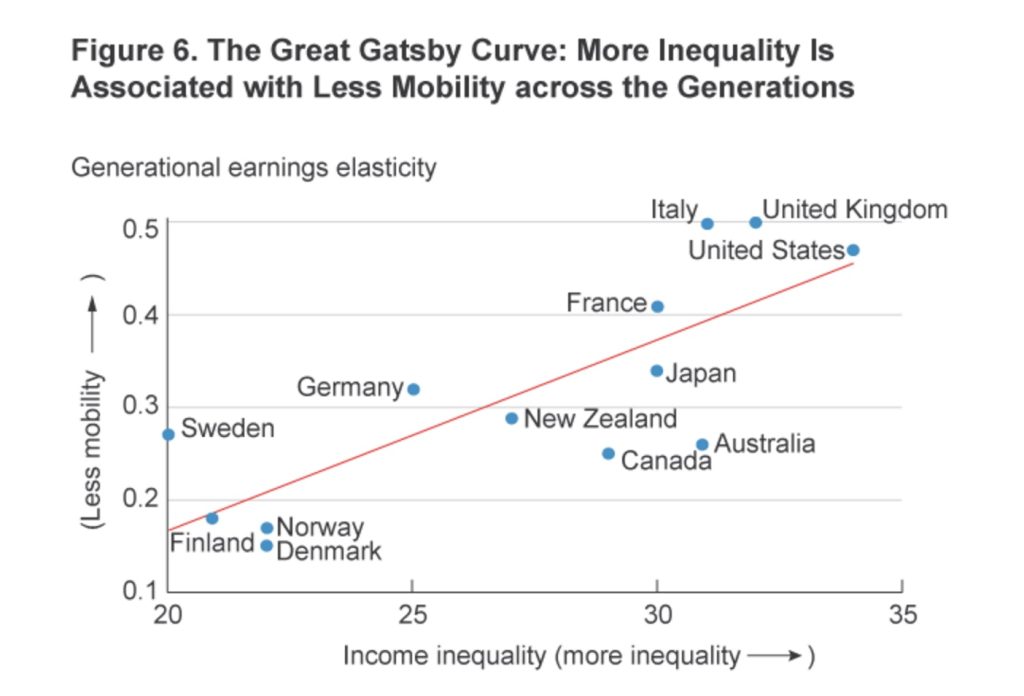

Income Inequality and Income Mobility Go Hand in Hand

I have previously written about the stunning state of income inequality in America. Two necessary ingredients of Americanism — meritocracy and momentum — are missing in America today. This article looks the relationship between income inequality and income mobility. We define income inequality as the extent to which income is distributed in an uneven manner among a population. We […]

Foreclosures are Way Down, But Not in the District of Columbia

Nationally, foreclosures are way down, but not in the District of Columbia. According to CoreLogic’s National Foreclosure Report for June 2016, the U.S. foreclosure inventory declined by 25.9% and completed foreclosures declined by 4.9% compared with June 2015. The number of completed foreclosures nationwide decreased year over year represents a decrease of 67.5% from the […]

Should I File Chapter 7 or Chapter 13 to Stop Foreclosure?

Which bankruptcy should I file? Chapter 7 is quick and easy, but Chapter 13 allows repayment of missed mortgage payments. Whether you file a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, the “automatic stay” goes into immediate effect. The automatic stay prevents your creditors from taking any steps to try to collect money from you. Both Chapter 7 […]

D.C. Bankruptcy Attorney Advocates for Student Loan Discharge

Brian V. Lee, the District of Columbia State Chair for the National Association of Consumer Bankruptcy Attorneys (NACBA) and principal attorney for Lee Legal, met with District of Columbia Congresswoman Eleanor Holmes Norton to discuss the student loan discharge in Chapter 7 bankruptcy. The meeting was part of “Hill Day at Home,” which allows NACBA […]

Realtors Should Not Turn Away Bankruptcy Clients

Realtors should not turn away bankruptcy clients. In fact, realtors shouldn’t have many concerns at all if approached by a client in bankruptcy. In most cases, bankruptcy does not complicate real estate sales very much at all. If the client is in Chapter 7 (liquidation) bankruptcy, usually the client needs cash quickly. Realtors often list […]

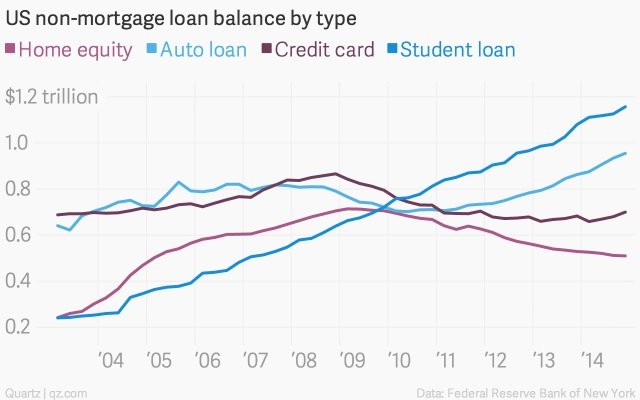

The Solution to Increasing Student Loan Defaults

In 2016, 43 million Americans carried a total of over $1.3 trillion in student debt. More than 40% of the nearly 22 million borrowers with federal student loans were in default or behind on their payments. Student loan defaults have been compared to the subprime mortgage meltdown of 2007-2010. In 2017, Americans owed over $1.48 trillion in student […]

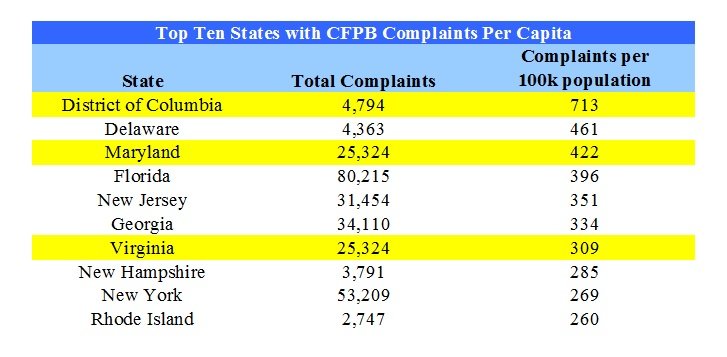

Washington DC Area Tops List for CFPB Complaints Nationwide

As of March 1, 2016, the Consumer Financial Protection Bureau (CFPB) handled approximately 834,400 complaints, including approximately 22,800 complaints. The Washington, DC area has three of the top seven jurisdictions for CFPB complaints per capita. By a wide margin, Washington, D.C. leads the nation in CFPB complaints per capita with 713 complaints per 100,000 residents. […]

Who Will Find Out If I File for Bankruptcy?

Are you ready to file for bankruptcy but stressed out because you’re not sure who will find out? It can be hard to pinpoint who will figure out or actually find out about your bankruptcy. But there are some basic rules of thumb. Before you file, it’s not uncommon to want to know the answer […]

Get A Credit Card After Bankruptcy

Not only can you get a credit card after bankruptcy, it is absolutely essential to repairing your credit. Regardless of whether you file a Chapter 13 or Chapter 7 bankruptcy, once you receive your discharge, you are eligible to get a credit card. Your specific circumstances will determine what kind of interest rates and credit […]