Foreclosures are Way Down, But Not in the District of Columbia

Nationally, foreclosures are way down, but not in the District of Columbia. According to CoreLogic’s National Foreclosure Report for June 2016, the U.S. foreclosure inventory declined by 25.9% and completed foreclosures declined by 4.9% compared with June 2015. The number of completed foreclosures nationwide decreased year over year represents a decrease of 67.5% from the […]

Should I File Chapter 7 or Chapter 13 to Stop Foreclosure?

Which bankruptcy should I file? Chapter 7 is quick and easy, but Chapter 13 allows repayment of missed mortgage payments. Whether you file a Chapter 7 bankruptcy or a Chapter 13 bankruptcy, the “automatic stay” goes into immediate effect. The automatic stay prevents your creditors from taking any steps to try to collect money from you. Both Chapter 7 […]

D.C. Bankruptcy Attorney Advocates for Student Loan Discharge

Brian V. Lee, the District of Columbia State Chair for the National Association of Consumer Bankruptcy Attorneys (NACBA) and principal attorney for Lee Legal, met with District of Columbia Congresswoman Eleanor Holmes Norton to discuss the student loan discharge in Chapter 7 bankruptcy. The meeting was part of “Hill Day at Home,” which allows NACBA […]

Realtors Should Not Turn Away Bankruptcy Clients

Realtors should not turn away bankruptcy clients. In fact, realtors shouldn’t have many concerns at all if approached by a client in bankruptcy. In most cases, bankruptcy does not complicate real estate sales very much at all. If the client is in Chapter 7 (liquidation) bankruptcy, usually the client needs cash quickly. Realtors often list […]

Who Will Find Out If I File for Bankruptcy?

Are you ready to file for bankruptcy but stressed out because you’re not sure who will find out? It can be hard to pinpoint who will figure out or actually find out about your bankruptcy. But there are some basic rules of thumb. Before you file, it’s not uncommon to want to know the answer […]

Get A Credit Card After Bankruptcy

Not only can you get a credit card after bankruptcy, it is absolutely essential to repairing your credit. Regardless of whether you file a Chapter 13 or Chapter 7 bankruptcy, once you receive your discharge, you are eligible to get a credit card. Your specific circumstances will determine what kind of interest rates and credit […]

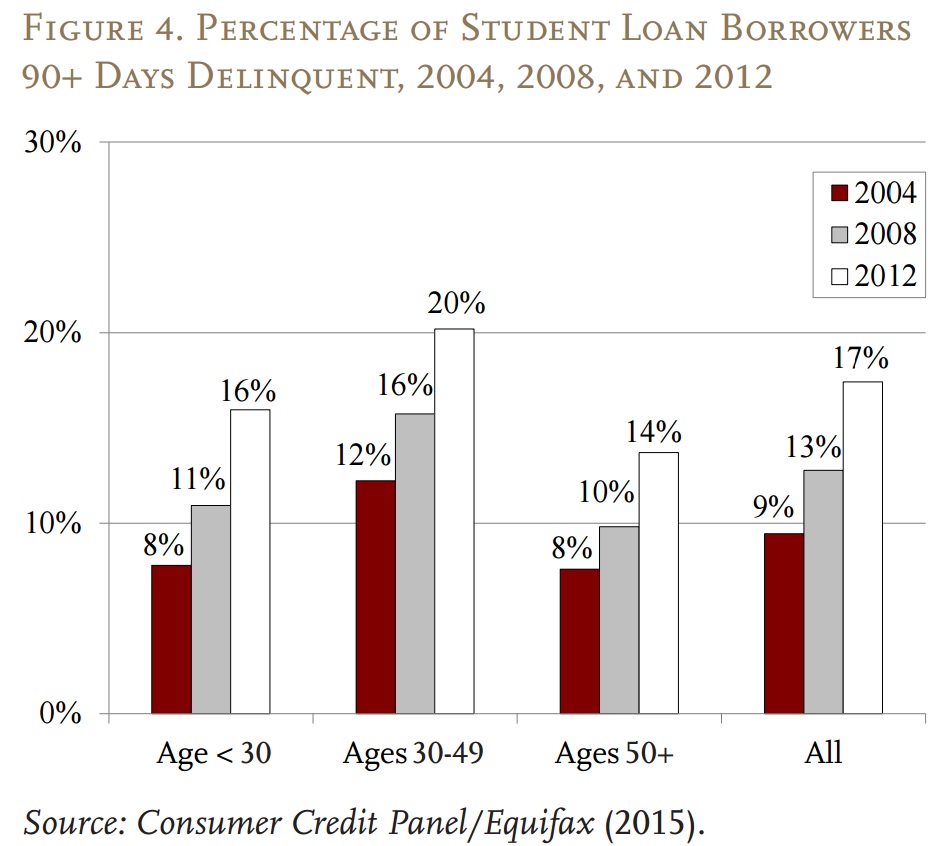

Student Loans Jeopardize Retirement for Older Americans

Retirement is supposed to be a time to leave behind the hassles and stress of the workforce. In many ways, retirement is the reward for a lifetime’s contribution to the economy and country. We usually consider student loans to be a problem for the young. But today’s retirees increasingly face crushing student loan burdens. Believe […]

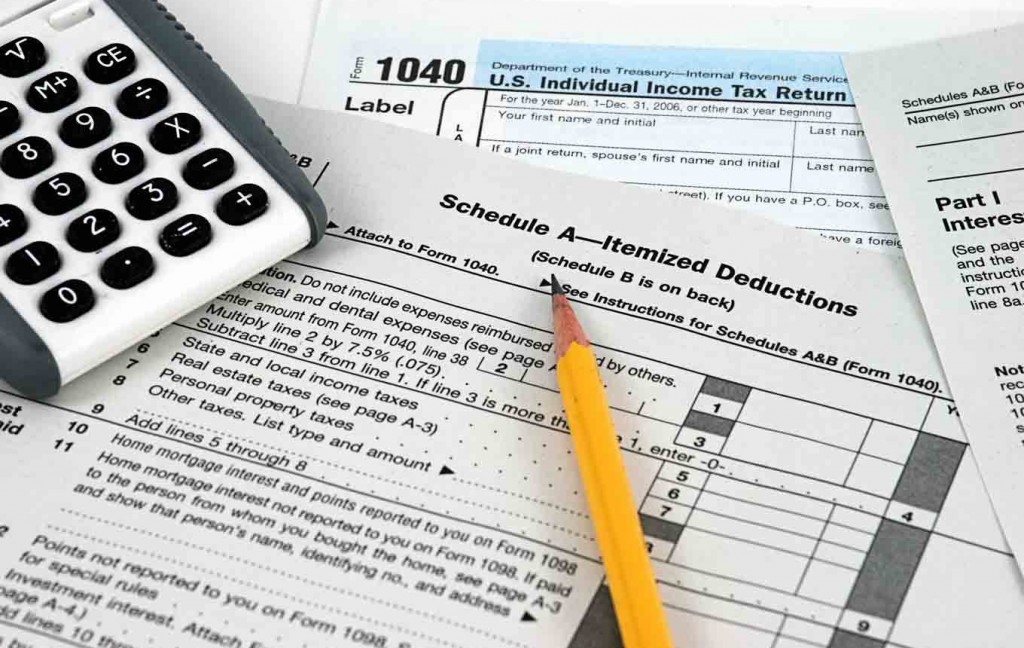

Debts Discharged in Bankruptcy are Not Taxable

Settled debts must be included in your income taxes If you settle a debt for less than you owe, the balance canceled or forgiven is taxable income. You must report any cancelled or forgiven debts as part of your gross income on your income tax return. The creditor will send you an IRS Form 1099-C […]

New Debt Limits for Chapter 13 Bankruptcy Take Effect

New debt limits for Chapter 13 bankruptcy took effect today. For cases filed on or after April 1, 2016, the new limits are: $394,725 for unsecured debt and $1,184,200 for secured debt. The former limits were $383,175 for unsecured debt and $1,149,525 for secured debt. The increase in debt limits essentially means that more people […]