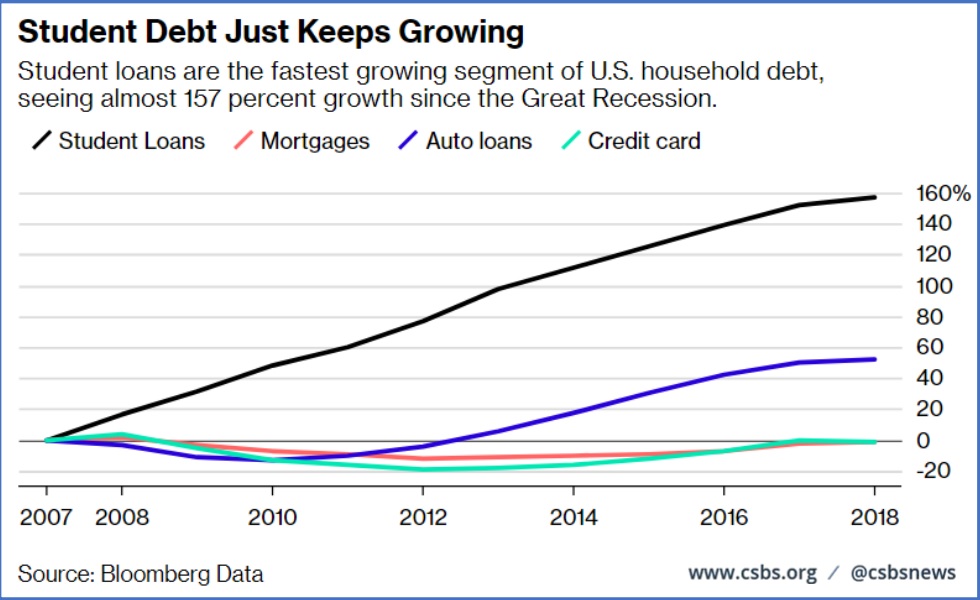

Student loan debt in America just keeps growing and now totals $1.6 trillion. As CNBC reports, hardly anyone is paying down their loans. Only 51 percent of borrowers who took out loans from 2010-12 have made any progress at all in paying down their debt. And since the Great Recession, student loans represent the fastest growing segment of U.S. household debt.

44.7 million Americans have student loans as of 2019. On average, each borrower has nearly $40,000 in loans. So where can borrowers turn to for student loan debt relief?

Student loan debt servicers

According to a 2020 report by the Conference of State Bank Supervisors, most federal student loan servicing is performed by third party servicers. Federal student loan servicing is dominated by just three companies that administer more than 80 percent of the total federal loan portfolio. These companies are Nelnet, FedLoan, and Navient. Federal loans represent approximately 79 percent of all student loans.

If you are having difficulty making your student loans, call your servicer first. Servicers often have options available, including forbearance and restructuring. These options will not affect your principal or interest. But getting a lower payment may allow you to make your rent and buy food. Make sure you explore your options under any income-based repayment plans that may be available to you.

But don’t put too much hope in servicer options. Their job is to collect. A recent Inspector General report found that 19 federal student loan servicers have exhibited failures in consumer protection. Servicers have employed substandard servicing practices including not informing borrowers about all repayment options and miscalculating payments under income driven repayment plans.

Student loan “debt relief” companies

Student loan debt collection can lead financially vulnerable borrowers to make poor choices. Sometimes borrowers will turn to student loan “debt relief” companies.

There are hundreds of private “debt relief” companies (or debt settlement companies) that solicit student loan borrowers. They promise to help reduce monthly payments or assist with loan forgiveness. These companies charge consumers high fees for services they can perform themselves. When it comes to seeking help managing student debt, the FTC says consumers should never pay up front to these types of companies.

Bankruptcy lawyers can only provide temporary student loan debt relief

Chapter 7 bankruptcy offers an imperfect solution. Unlike almost every other kind of unsecured debt, student loan debts are generally not dischargeable in Chapter 7 bankruptcy. That’s because the Bankruptcy Code allows discharge of student loans only where you can demonstrate “undue hardship.” The standard is nearly impossible to meet for most debtors. Chapter 7 bankruptcy does allow you to discharge other types of debts, however, which might make living with your student loan payment easier.

In a Chapter 13 bankruptcy, on the other hand, you can choose to include your student loans in your Chapter 13 repayment plan of reorganization, or to pay those loans directly. Like a Chapter 7 bankruptcy, Chapter 13 does not discharge unpaid student loans at the end of the plan. Over a period of three to five years, your Chapter 13 bankruptcy allows you to pay your student loans with reduced monthly payments — or to pay them off completely. Consult with an experienced bankruptcy attorney to determine whether this option might be right for you.